Last Updated on January 20, 2026 by Caesar Fikson

An iGaming platform is the software backbone that lets an operator run real-money gambling online: it authenticates players, hosts or embeds games, moves money, enforces rules, detects fraud, and turns a chaotic stream of clicks into auditable financial events. If you remember one thing, make it this: a “platform” isn’t the games. It’s the machinery that makes games legally playable, payable, measurable, and scalable.

Here’s the beginner trap: people shop for platforms the way they shop for a website theme. “Looks modern. Has slots. Has payments. Done.”

That’s how you end up rebuilding your entire stack 9 months later because your KYC can’t scale, your bonus engine leaks, your PSP settlement is a spreadsheet nightmare, and your fraud filters are basically vibes.

We’re going to frame platforms the way grown-ups do: as infrastructure decisions that control unit economics, compliance risk, and operational workload. Not as a shiny lobby. 😌

What an iGaming platform is?

An iGaming platform is a connected set of systems that manage three things at once:

- Player identity and permissions (who is this, where are they, are they allowed to play, what limits apply)

- Money movement (deposit, wagering, bonus balance, withdrawal, chargebacks, reconciliations)

- Game and bet execution (spins, hands, bets, settlements, cancellations, jackpots, reporting)

A platform can be a single vendor “suite” or a modular stack where different vendors handle different layers. In practice, it’s usually a Frankenstein blend of “suite-ish” plus “bolt-ons” because operators love control… until they have to maintain it.

Why platforms matter more than beginners think?

Games are content. Platforms are governance.

The same slot can print money on one operator and bleed on another because the platform decides: deposit friction, bonus abuse exposure, geofencing reliability, session stability, anti-fraud aggressiveness, wallet architecture, and how fast you detect that something is off.

I’m opinionated here: if your platform can’t produce clean, auditable event logs (who did what, when, from where, with which balance, under which bonus rules), you don’t have a platform. You have a liability with a lobby attached. 🙃

The iGaming platform “stack” in plain English

Beginners hear “platform” and imagine one box. In reality it’s layers:

- The front end: website/app lobby, navigation, localization, responsible gaming UI

- The player layer (PAM): registration, login, KYC status, verification workflow, limits, segmentation

- The wallet: real balance vs bonus balance, wagering requirements, transaction ledger, withdrawals

- The game layer: game aggregation, remote game server (RGS) connections, session tokens

- The sportsbook layer (if applicable): odds feeds, betslip, risk management, settlement engine

- The compliance layer: AML rules, KYT signals, sanctions checks, jurisdiction rules, reporting

- The risk layer: fraud scoring, device fingerprinting, velocity checks, bonus abuse detection

- The ops layer: back office, CMS, promotions, CRM, customer support tooling

- The data layer: analytics, cohorting, attribution, reporting, BI, exports, data warehouse

You can buy these as one “all-in-one,” or compose them. Either way, you need to understand what you’re actually buying.

Types of iGaming platforms beginners run into

People love lists here, but lists make you lazy. So let’s talk in categories, then show you what breaks.

Casino platform suites usually cover PAM + wallet + game aggregation + back office. They’re optimized for content velocity: onboard games fast, run promos, push segments, track KPIs.

Sportsbook platforms are their own beast. They’re not “casino plus a tab.” They depend on real-time data feeds, pricing, bet settlement logic, risk management, and low-latency UX under live conditions. If your sportsbook stack is weak, your “product” is basically a delayed odds viewer.

Hybrid platforms combine casino + sportsbook (sometimes poker, bingo, esports).

Sounds efficient. Often is.

But… hybrid complexity is where the hidden costs live: wallet consistency, cross-vertical bonuses, unified player view, and a reporting layer that doesn’t collapse into contradictions.

White-label / turnkey platforms trade customization for speed. If you’re entering a market quickly, it’s attractive. If you’re trying to differentiate, you’ll hate it later. The “later” arrives faster than you think.

Affiliate/partner platforms (separate from the gambling platform) run acquisition: tracking, commission logic, fraud filtering, payouts, partner portals. If you scale without one, you will pay for it in disputes, leakage, and angry super affiliates. Good example is Scaleo affiliate software.

Payment platforms aren’t just “a gateway.” Payments in iGaming are a mini-industry: routing, risk scoring, local methods, chargeback management, AML signals, payout rails, bank reporting. Payments shape conversion rates more than your hero banner ever will.

A beginner framework for choosing the right platform

Forget feature checklists. Use a decision flow that forces reality.

- First, define your operating model. Are you building a brand with a long runway, or launching fast to test geo/offer fit? That single decision changes everything. If you’re testing, white-label can be rational. If you’re building a defensible operator, choose control points you refuse to outsource (usually wallet logic, risk rules, data).

- Second, map your jurisdictions. Licensing and compliance aren’t “later.” They are the product constraints that determine what tech you can even run. Geo rules will dictate KYC depth, AML reporting, RTP disclosures, player protections, and even what payment methods are viable.

- Third, pick your differentiation. If your differentiation is “we have lots of games,” you don’t have differentiation. Your differentiation has to be something the platform can actually enforce: faster onboarding, better VIP lifecycle management, localized payments, aggressive fraud defenses without false positives, or a retention machine (bonus logic + segmentation + CRM).

- Fourth, model operational load. Who runs promotions? Who configures KYC flows? Who reconciles PSP settlement? Who handles provider disputes? If the answer is “we’ll figure it out,” congratulations, you’ve just invented future chaos.

- Fifth, validate integration reality. A platform can “support” a thing and still integrate it like a nightmare. Demand sandbox access, test webhooks, measure retry behavior, check idempotency, and confirm the data model isn’t a horror show.

If you want a quote-worthy line to steal: A platform choice is a staffing decision disguised as software.

Core components you should understand

Player account management (PAM)

PAM is the “identity + permissions” brain. It manages registration, login, session control, KYC status, duplicate detection, geolocation enforcement, and responsible gaming settings.

Mechanism: PAM usually issues a player ID, stores verification metadata, and controls whether downstream systems can create a gameplay session or approve withdrawals.

Operational outcome: a good PAM reduces manual reviews, prevents multi-accounting leakage, and keeps compliance workflows consistent.

Beginner gotcha: if your KYC flow is a bolt-on that can’t sync status changes in real time to wallet + game sessions, you’ll end up with players who can deposit, play, and then get stuck at withdrawal. That’s how chargebacks and regulator complaints are born.

Wallet and ledger

The wallet is where “real money vs bonus money” becomes enforceable logic. Not just balances, but a ledger: every deposit, bet, win, bonus credit, bonus conversion, withdrawal request, fee, reversal.

Mechanism: serious platforms operate a double-entry ledger or an equivalent auditable transaction journal, not “balance updates.”

Operational outcome: clean reconciliations, fewer disputes with providers/PSPs, faster investigations when something looks wrong.

Opinion: if a vendor can’t explain their ledger model clearly, that’s not “proprietary.” That’s messy.

Game aggregation and RGS integrations

Aggregation connects you to game providers. It handles session tokens, game catalogs, jurisdiction filtering, and often jackpot integration.

Mechanism: the platform calls provider APIs to launch sessions; providers call back with bet/win events; the platform applies wallet logic; reporting collects it all.

Operational outcome: faster game onboarding, fewer integration projects, consistent RTP and game availability control.

Gotcha: “We integrate Provider X” can mean “we have their games” or “we have their games but the round-transaction mapping is fragile and breaks on edge cases.” Ask about round IDs, rollback handling, and what happens on network timeouts.

Payments and PSP orchestration

Payments are conversion. Also risk. Also compliance.

Mechanism: deposit flows involve tokenization, 3DS/strong customer auth where applicable, fraud scoring, routing to different PSPs, and settlement reporting; withdrawals trigger AML checks, velocity rules, and payout rails.

Operational outcome: fewer failed deposits, faster payouts, lower chargeback rates, cleaner AML audit trails.

Beginner truth: “More payment methods” is not automatically better. More methods can mean more reconciliation complexity, more fraud surface area, and more vendor management overhead.

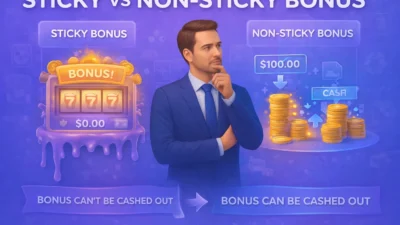

Bonuses, promos, and segmentation

Bonuses are not marketing fluff. They’re a rules engine that affects unit economics.

Mechanism: bonus engines apply eligibility rules, attach wagering requirements, restrict games/providers, enforce max cashout limits, and track fulfillment.

Operational outcome: higher retention, controlled promo spend, lower bonus abuse.

Gotcha: if promo rules can’t restrict by provider/game category properly, you’ll get the classic “low volatility grind” abuse where players milk bonus EV while your margin politely evaporates.

Risk, fraud, and anti-abuse

Fraud in iGaming isn’t one monster. It’s a zoo.

Mechanism: device fingerprinting, IP/ISP heuristics, proxy/VPN detection, velocity checks, behavioral patterns, duplicate payment instrument detection, bonus abuse scoring, and manual review tooling.

Operational outcome: reduced budget leakage, fewer chargebacks, fewer affiliate disputes, higher trust with PSPs.

Hot take: “AI fraud detection” is often marketing glitter unless they can show what signals feed the model and how they handle false positives. If your risk system blocks legit VIPs, you’ve invented churn.

Compliance and responsible gaming

This is where “platform” becomes “licensed business.”

Mechanism: KYC checks, age verification, self-exclusion, deposit/time limits, AML monitoring rules, suspicious activity reporting workflows, jurisdiction-based content gating.

Operational outcome: reduced regulatory exposure, fewer account escalations, safer player lifecycle management.

Beginner trap: treating responsible gaming as UI toggles. The enforcement has to be backend-level or it’s theatre.

A comparison table that actually helps

Most tables compare features. That’s cute. Let’s compare what you’ll pay for in pain.

| Platform approach | What you gain fast | What breaks first | Hidden cost center | Best fit |

|---|---|---|---|---|

| Turnkey / white-label suite | Speed to launch, fewer vendors | Differentiation, data ownership, custom promo logic | “Change requests” fees, roadmap dependence | First launch, market testing, low internal tech |

| Modular “best-of-breed” stack | Control, flexibility, vendor leverage | Integration glue, inconsistent data models | Engineering + QA + incident response | Operators with tech team, multi-geo complexity |

| Casino-first suite + sportsbook add-on | Quick casino revenue, later expansion | Wallet consistency across verticals | Reporting reconciliation, bonus logic conflicts | Casino-led brands adding sports |

| Sportsbook-first stack + casino add-on | Strong live betting performance | Lobby UX and content ops | Content management, segmentation tooling | Sports-led brands adding casino |

| Aggregator-heavy “content factory” | Huge game catalog quickly | Bonus abuse, margins | Risk tooling and promo governance | Operators competing on breadth + retention |

| Platform + dedicated affiliate system | Acquisition scale, dispute control | Nothing breaks early if integrated well | Data plumbing between tracking and BI | Brands using affiliates seriously |

Read that “what breaks first” column twice. It’s basically the future.

What docs don’t tell you

Docs tell you the happy path: integrate provider, launch games, process payments, run bonuses. Reality is the unhappy path.

What happens when a provider sends a win callback twice because their webhook retried? If your wallet system isn’t idempotent, you’ll credit twice. Then you’ll reverse. Then the player screams. Then support escalates. Then compliance asks for audit logs you don’t have. That’s a real Tuesday.

What happens when a bet is placed, but the settlement callback arrives late, after a withdrawal request? If your ledger can’t lock funds correctly, you will either overpay or block legit withdrawals.

What happens when your KYC vendor has downtime? Do you hard-block deposits, soft-block withdrawals, or allow limited play? The “right” answer depends on jurisdiction, risk appetite, and your fraud profile. Most beginners don’t even know they need an answer.

What happens when a PSP changes a risk rule and your deposit acceptance drops 18% overnight? If you don’t have routing and fallback logic, your paid acquisition spend becomes a donation.

Docs don’t tell you how brittle the edges are. Vendors with mature incident playbooks do.

Here’s the punchline: the platform you want is the one that fails gracefully. Not the one with the prettiest screenshots.

Pro-Tip (technical)

Pro-Tip: When evaluating a platform, run a synthetic “click-to-cashout” test in a sandbox environment and record p95 latency and failure behavior across the full lifecycle: registration → KYC submission → deposit → game session creation → bet/win callbacks → bonus application → withdrawal request → AML hold → payout. Ask for raw webhook logs, retry policies, and idempotency guarantees (idempotency keys, duplicate event handling, rollback rules). If they can’t show it, it doesn’t exist.

iGaming platforms and the money math

Beginners obsess over setup fees. Veterans obsess over leakage.

Leakage happens when the platform lets value slip through cracks: bonus abuse, fraud, misattribution, reconciliation errors, delayed risk actions, or affiliate disputes. Those aren’t “edge cases.” They’re the profit margin.

Mechanism-to-outcome link is simple: tighter enforcement logic + better observability = fewer losses and faster decisions. Observability here means you can answer, quickly: which cohort is failing deposits, which PSP is spiking chargebacks, which game provider is producing abnormal RTP, which affiliates are sending suspicious traffic patterns.

If your platform can’t export clean event data to a warehouse (even if you’re not using one yet), you’re blind. And blindness is expensive.

The 2026 shift beginners should know about

2026 isn’t just “more regulation” and “more mobile.” The shift that matters is automation and real-time decisioning becoming table stakes.

Risk engines are moving from static rules to adaptive scoring, not because it’s trendy, but because fraud patterns mutate faster than humans can update spreadsheets. Promo governance is becoming more granular because operators are sick of paying for “growth” that’s actually exploitative behavior. And platform vendors are quietly putting more emphasis on server-side instrumentation, event streams, and near-real-time BI because decision latency kills unit economics.

If you’re a seasoned operator, you already feel it: the winners aren’t the ones with the most games. They’re the ones who can measure and react fastest, without breaking compliance.

Our Experience with platform selection for beginners

We’ve seen the same storyline play out so often it’s basically a genre.

A new team picks a “popular” platform because the demo looked smooth. Launch is quick. The first month feels exciting. Then the real world arrives: one PSP starts declining a key country; chargebacks tick up; affiliates complain about attribution; VIP asks for faster withdrawals; compliance demands reporting that the back office can’t produce without manual stitching.

The platform wasn’t “bad.” It was mismatched.

The most painful mismatch is operational maturity. A beginner team picks a modular stack because it sounds sophisticated, then discovers they now own integration QA, on-call incident response, and reconciliation logic. Suddenly you’re hiring engineers not for growth, but to stop fires.

The second most painful mismatch is data. If you can’t unify player identity across PAM, wallet, payments, CRM, and game events, you can’t segment properly, can’t measure LTV reliably, and can’t prove what happened during disputes. You end up “optimizing” based on partial truth, which is how people burn marketing budgets with confidence.

Our blunt rule: if you don’t have a strong tech and ops bench yet, pick a platform that has boring reliability and mature tooling. You can earn complexity later.

Build vs buy: the decision nobody likes

“Should we build our own platform?” The romantic question. The practical answer: you’re not building a platform, you’re building a regulated financial system that happens to show games.

If you build, you will need: secure auth, KYC orchestration, AML workflows, wallet ledgering, provider integrations, payment routing, fraud detection, observability, and reporting. And you will need to maintain it under compliance pressure. That’s not a side project. That’s a company identity.

Buying is rational. Building is identity-level commitment. Choose accordingly.

Questions you should ask vendors (without sounding like a newbie)

Instead of “Do you support Provider X?” ask: how do you handle rollback events and duplicate callbacks, and what is your idempotency model?

Instead of “Is your platform scalable?” ask: what’s your peak concurrent sessions in production, and what do you throttle first under load?

Instead of “Do you have fraud tools?” ask: what signals feed your risk scoring, how do you tune false positives, and can we configure rules by geo and payment method?

Instead of “Do you do reporting?” ask: can we export raw event streams or at least structured logs (player, session, round, transaction) for independent BI?

Instead of “Is it compliant?” ask: which jurisdictions are you actively supporting today, and what’s your update process when regulations change?

You don’t need to be rude. Just be precise. Precision is confidence. 😏

Beginner glossary you’ll hear constantly

PAM: Player Account Management

KYC: Know Your Customer identity verification

AML: Anti-Money Laundering monitoring and reporting

PSP: Payment Service Provider

RGS: Remote Game Server (provider side)

Aggregation: one integration to many game providers

Wallet/ledger: the system recording financial events and balances

Segmentation: grouping players by behavior/value for CRM/promo logic

Idempotency: handling repeated events without duplicating outcomes

Rollback: reversing a bet/win due to error/timeouts/provider corrections

If these terms start to feel normal, you’re already less beginner than most.

Final thought

If your platform vendor vanished tomorrow, would you still understand your own player lifecycle well enough to run—identity, money, risk, compliance, data—or have you outsourced the brain of your business and kept only the skin? 🤔